proposed estate tax law changes 2021

Is the Leading Authority on Corporate Tax Law. Federal estate and gift tax are assessed at a flat rate of 40.

New York Estate Tax Everything You Need To Know Smartasset

The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as adjusted for inflation presently 11700000 per person will be intact through the end.

. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. November 16 2021 by Jennifer Yasinsac Esquire. For 2021 the exemption will be 73600 for single filers and 114600 for married couples filing jointly.

In addition the proposed bill. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction of the Federal Estate Tax Exemption. November 03 2021.

The proposed impact will effectively increase estate and gift tax liability significantly. Enter the Sensible Taxation and Equity Promotion Act of 2021 proposed legislation targeting estate taxes. You can also give away up to 15 thousand to as many individuals as youd like without owing any gift tax.

This marginal rate would apply to. In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives. Some potential changes include.

President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these changes if they later become adopted as compared to the effective date the new tax law changes may be passed by Congress or a later effective date such as beginning January 1. C unmarried individuals with taxable income. Any modification to the federal estate tax rate.

Ad From Fisher Investments 40 years managing money and helping thousands of families. PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021. Unrealized gains would be taxed when assets transfer at death or by gift as if they were sold.

An elimination in the step-up in basis at death which had been widely discussed as. Capital gains tax would be increased from 20 to 396 for all income over 1000000. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure.

Potential Estate Tax Law Changes To Watch in 2021. These proposals if enacted would become effective for individuals dying after. If you inherit assets that collectively amount to over 1 million--whether its a business jewelry artworks etc--you are required to pay capital gains taxes as if the previous owner who passed away had sold it to you before you took ownership.

However on October 28 and then again on November 3 the House Rules. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. The current lifetime exemption is 117 million dollars for an individual and 234 million for a.

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. The basic exclusion amount will be a 35 million estate tax exemption and a 1 million lifetime exemption for gifts. On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act detailing multiple changes to current tax law in order to increase tax revenue.

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. Changes to the Alternative Minimum Tax In 2021 the AMT exemption and phaseout amounts will now adjust for inflation.

Federal tax laws allow for an annual exclusion amount that can be gifted from any one person to any other person in any given year without using up any estategift tax exemption. Ad Wells Fargo Advisors Can Help You withEstate Planning. The time to gift is 2021change is on the horizon.

Proposed Tax Law Changes. With Access To Our Free Estate Planning Checklist You Can Start Developing A Plan Today. The timing and extent of potential changes to gift and estate tax laws are unclear.

The law would exempt the first 35 million dollars of an individuals gross taxable estate or 7 million for a married couple from estate tax. It remains at 40. The AMT will begin to phase out at 523600 for single filers and 1047200 for married couples filing jointly.

State death taxes paid are deductible from the federal gross estate for estate tax purposes. As mentioned above in 2021 as long as your estate is worth less than 117 million for an individual or 234 million for a married couple when you die no estate tax will be owed upon your death. Reducing the exemption increasing the estate tax rate increasing the capital gains tax rate and eliminating the basis adjustment.

B heads of household with taxable income exceeding 425000. A 1959 Tax Law May Cause Compliance Headaches In Your Business. A married individuals filing jointly with taxable income exceeding 450000.

Following weeks of negotiations between President Joe Biden and congressional Democrats the White House released a retooled framework for the Build Back Better Act on October 28. The following is a summary of most of the tax law changes impacting estate planning included in pending legislation as released on 91321 by the House Ways Means Committee. Current Law As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US.

This memo does not go into the significant proposed changes to income taxes increased income tax for single and joint filers and an increase in capital gains tax rates. September 23 2021 Proposed Tax Law Changes Impacting Estate and Gift Taxes David Bussolotta Pullman Comley LLC Follow Contact As many people are aware Congress is considering changes to the. Here is what we know thats proposed.

While there has been a lot of confusion about various estate tax law changes that are currently being proposed in Washington below is a helpful summary of the tax proposals currently being considered and the implications it could have on youSenator Bernie Sanders Proposed Estate Tax Legislation the 995 Percent Act In March Senator Bernie Sanders. Net Investment Income Tax would be broadened to cover more income if your total income was greater than 400000. The proposed bill would increase the top marginal individual income tax rate to 396 effective after December 31 2021.

The Effect of the 2017 Trump Tax Cuts. December 6 2021. The exemption is unlimited on bequests to a surviving spouse.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Bureau of Labor Statistics Consumer Price Index. Married couples may give up to 23400000.

A persons gross taxable estate includes the value of all assets including even proceeds payable via life insurance policies. Proposed Tax Changes Affecting Estate Planning Are Moving Through Congress Harder Mark September 22 2021 On September 13 The Ways and Means Committee of the House of Representatives released sweeping tax proposals affecting both. Download Our Free Guides Today.

The exemption was indexed for inflation and as of 2021 currently stands at 117. Under current law the estate tax on a net taxable estate of 11700000 will be zero. The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person.

Arkansas Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

2021 Estate Income Tax Calculator Rates

A Complete Estate Plan Looks Like This Estate Planning How To Plan Binder Planning

Estate Tax Definition Federal Estate Tax Taxedu

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Iowa Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Colorado Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

New Estate And Gift Tax Laws For 2022 Youtube

Minnesota Estate Tax Everything You Need To Know Smartasset

Proposed Estate Tax Change May Require You Take Action In 2021 Youtube Estate Planning Checklist How To Plan Estate Tax

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Estate Tax Exemption 2021 Amount Goes Up Union Bank

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

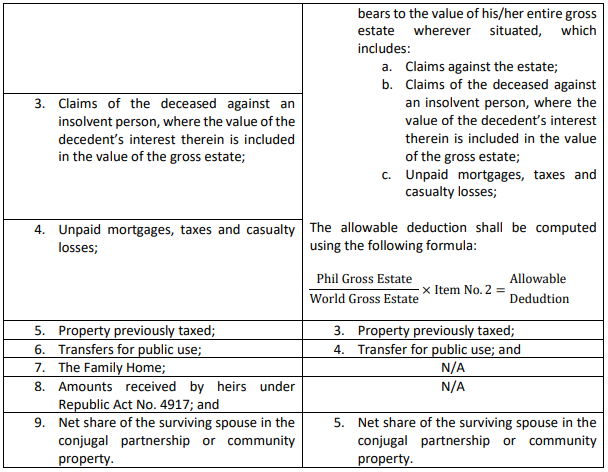

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology